Demystify Your Organization Funding

Funding student organization programming happens a little differently at every campus, but it is commonly complicated. Institutions often use system accounting software that student leaders cannot access, leading to even wider gaps in student knowledge of the organization funding process than those that may already exist due to unclearly identified responsible parties, rules and regulations. Campuses can gain massive benefits to the efficiency of their process when they aren’t fielding frustrated student complaints and confused requests, a dilemma we have seen addressed with a commitment to transparency in organization accounting and budgeting. One campus in particular has shown fantastic success in using Engage tools to meet this goal.

Stevens Institute of Technology

The Stevens Institute of Technology uses Engage to comprehensively manage the finances of their 135 organizations. Students make all budgeting, funding and purchase requests through their platform—called “Ducklink”—on campus. Before making a request, the organization officer can review details of all previous requests and their history right through their organization page, as well as the exact documented balance of each of their organization’s accounts. Requests move through a series of stages, and student leaders are always able to review the status of their request, comments on their request and relevant contacts directly on Engage.

Treasurers and student leaders alike are more informed, fiscally responsible and are better able to maximize their allocated funds each semester.

– Chris Shemasnki, Associate Director of Student Life

Part of Stevens’ success lies in their excellent training strategy. Rather than maintaining Engage as a separate training, it is integrated into training that is outcome oriented: “Interested in getting funding for your organization’s event? Learn how to do this through Engage.” This training model and corresponding adoption of Engage has helped ensure student organizations stay on budget, purchase the items they were approved to purchase in their original budgets and use past transactional data to inform future requests. The training is held by the assistant director of financial advising across the fall semester.

Training can’t be the only answer—sometimes there’s a lengthy time gap between when a training is held and when a request needs to be completed and that can’t always be avoided. Another great strategy used by this campus is to ensure their forms and processes are rich with detail.

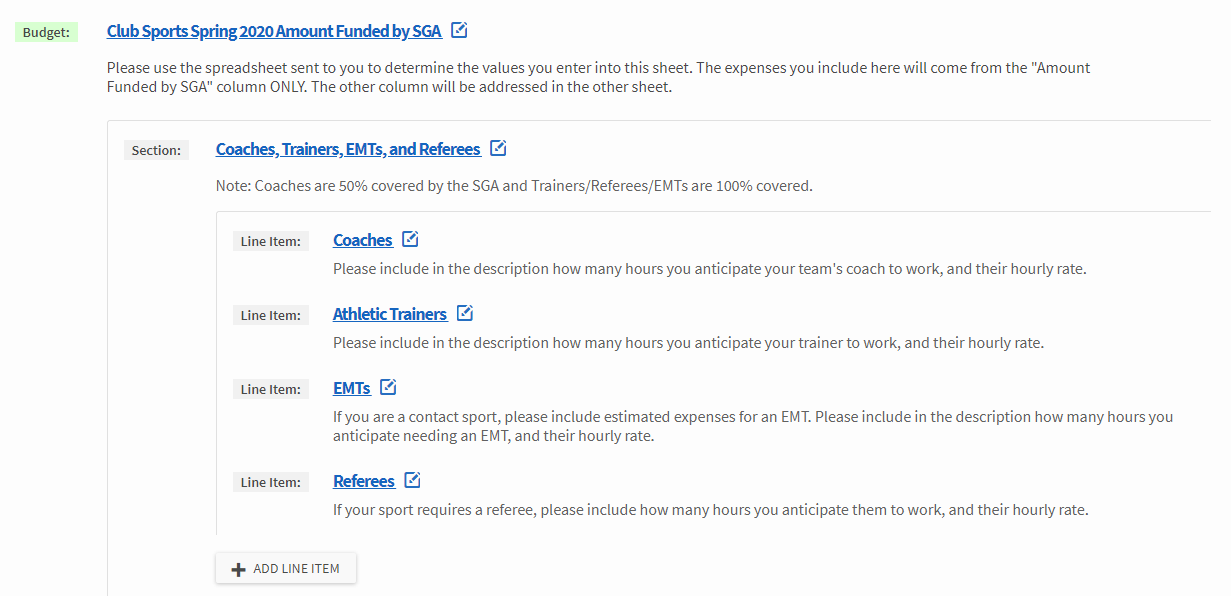

Notice that in the above budget request, relevant policies and procedures are explained in each budgeting line item. Engage’s budgeting tool can also be configured to automatically apply certain checks to a request, such as ensuring a specific line item does not exceed a given amount, or that the sum of multiple line items does not exceed a specific total. This ensures students aren’t making requests sight unseen—students start getting feedback about their request even earlier in the process.

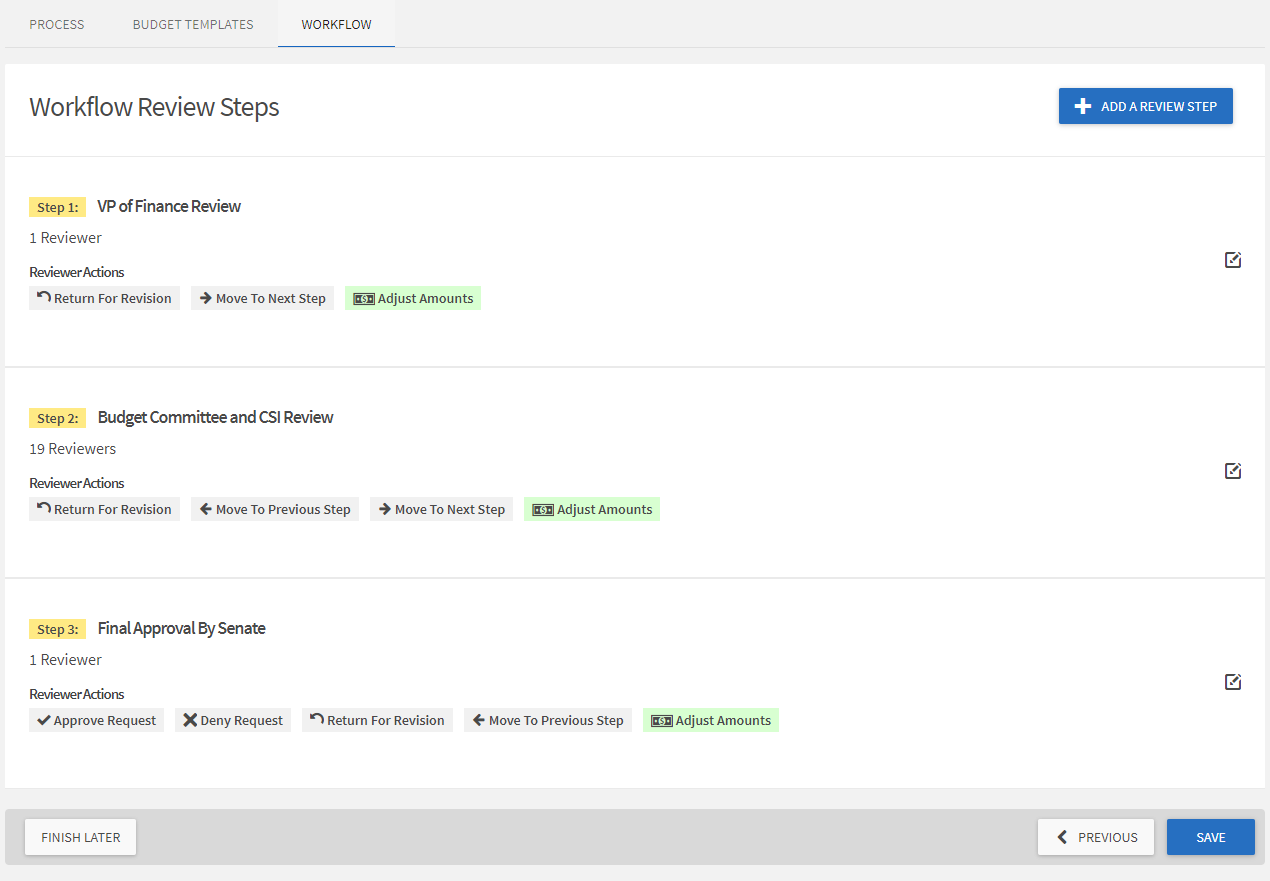

The budgeting process allows for a multi-step, multi-reviewer workflow with a variety of permissions. For example, in the Stevens Spring 2020 budget request, any reviewer can move the request through stages, return the request for revision, adjust line item amounts or comment on the request, but only the Senate can make a final determination on the request.

After receiving their budgets, organization leaders also enter purchase requests for individual costs associated with their organization or programming. Entering the request places the amount requested as “encumbered” on the organization’s account page until those requests have been processed by an administrator, ensuring that even large organizations that may have a number of requests pending at any given time can have an accurate pulse on their available funds.

Stevens Institute’s model allows them to ensure transparency between organization leaders, request reviewers and administrators. Managing an organization’s account can be intimidating for the average college student, but a thorough and clear process not only helps the institution, it also develops strong money management and critical thinking skills a student can benefit from after graduation.